Demande sur mesure

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous avez un besoin spécifique ? Vous souhaitez être accompagné et bénéficier d’une solution sur mesure ?

Nous contacter

L'équipe RH reste à votre écoute pour toute demande d'information complémentaire.

Nous contacter

Vous êtes intéressé(e) par une solution, vous recherchez plus d’informations ou souhaitez nous faire part de vos besoins.

Nous contacterAccueil > Actualités > Press release August 1st, 2023French automotive market in great shape in July

French automotive market confirms its upward trend. After an upturn in the first half of the year, July was no exception. The new car market is up 20%, for the twelfth consecutive months in a row. The same applies to the used car market, which began recovering in June after a long series of months of decline.

According to AAA DATA, the augmented data expert, new passenger car registrations amounted to 128 946 units (+20% vs July 2022).

The market also outperformed July 2021 levels, where 115,713 new private cars had been recorded. However, there’s still a long way to go back to July 2020 (178 90 units) and July 2019 levels (172 224 units).

In the automotive sector, June is traditionally strongly performing with the highest number of registrations, undoubtedly a do not miss month, often marked by open days and numerous sales events. June 2023 lived up to its billing, and above all, maintained the market’s upward trend. According to AAA DATA, the augmented data expert, the new passenger cars segment is up 12% compared to June 2022 with 190 847 registrations. The new LCV segment follows a similar pattern with a 16.9% growth to 42,700 units.

Marie-Laure Nivot, Head of Automotive Market Analysis, at AAA DATA: ‘’Hybrids are a good alternative to act and commit towards ecological transition, thanks to their versality. Their electric engine is an appropriate use for short distances in town, while the internal combustion engine is better suited to longer distances.’’

Electric vehicles (13% market share) continue to gain momentum, with sales up 32% to 16,866 registrations. But how long will the enthusiasm keep going on? The question is worth asking, given that the price of an electric vehicle remains very high (average list price in the first half of 2023: 41,473 euros). Moreover, demand seems for the moment to be essentially sustained by the existence of the ecological bonus

1 - Tesla

2 - Dacia

3 - Renault

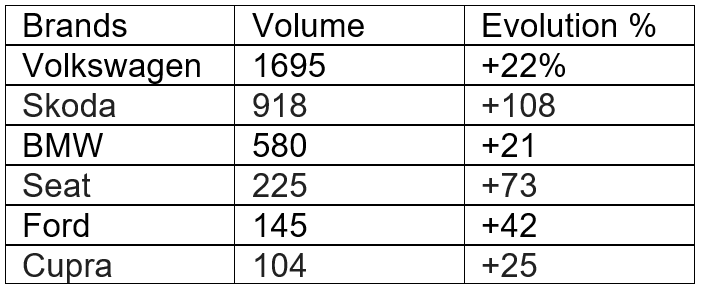

On the other hand, while petrol engines continue to grow (+16% to 48,371 registrations), diesel has not breathed its last: while overall registrations are down again (-29% to 12,497 units), some brands surprisingly saw their sales increase in July.

Pertaining to new passenger car customer profiles, purchases by non-automotive companies were very buoyant, up 39% to 21,092 registrations, while public-sector customers were also thriving (+58), although volumes were lower at 1,024 registrations. Private individual customers, who account for 45% of the market, exhibited a less dynamic trend (+21% to 58,584 registrations), no doubt due to a purchasing power of households burdened by inflation.

In terms of body styles, July confirmed the success of SUVs i.e., all-terrain/off road vehicles. They claimed no less than 47% of the market (up to 25% to 60,652 registrations), making them the market’s leading body type. The largest models are the most successful, with increases of 360% for F-SUV luxury cars (230 registrations), 95% for E-SUV large tourers (1,118 registrations) and 66% for D-SUV family cars (8 935 registrations). Smaller bodies are also popular: +29% for C-SUV compacts (27,486 registrations) and +6% for B-SUV multi-purposes cars (22,585 registrations). The balance of SUV registrations rests in the A-segment city cars.

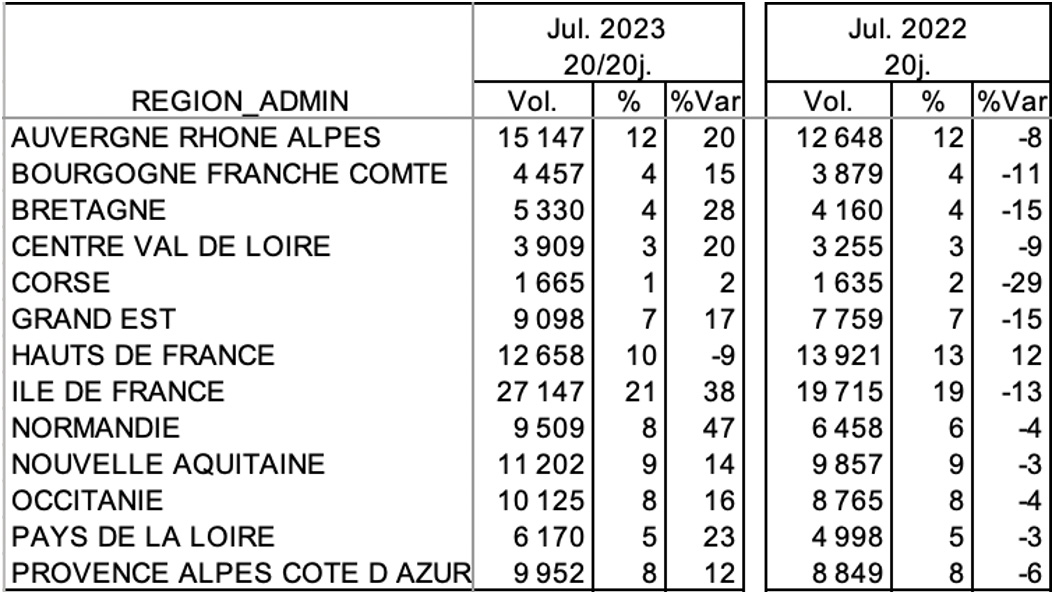

On the new passenger car market, one thing is clear: not all regions are in the same boat. Momentum is particularly strong in Normandy (+47% to 9,509 registrations), followed by runners-up Ile de France (+38% to 27,147 registrations) and pays de la Loire (+23% to 6,170 registrations). On the other hand, Hauts de France (-9% to 12,658 registrations), Corsica (+2% to 1,665 registrations) and Provence Alpes Côte d’Azur (+12% to 9,952 registrations) are in the bottom three.

In a context where new car production was heavily hamstrung, due in particular to semi-conductor shortages coupled with ongoing engine type changes, have the French remained loyal to their brand?

According to AAA DATA, the brand loyalty rate remained stable between 2022 and the first half of 2023 (58%) and the acquisition rate, consequently at 42%. The Dacia Sandero topped the podium in the first half of 2023, followed by runners-up Renault Captur and Dacia Duster respectively. A year earlier, the ranking was slightly different: 1. Dacia Sandero; 2. Renault Clio IV; 3. Renault Captur.

Interestingly, the Dacia Sandero also claims the top podium in the gain of new customer battle. Runner-up is Renault Captur followed by Dacia Duster 2 into the top three. A year earlier, Dacia was already the big winner, followed by Renault Clio IV and Renault Captur.

While 93% of customers acquiring a new vehicle in 2023 had already bought a new vehicle previously (average length of ownership 5.6 years), 30% had financed it by leasing. Regarding the acquisition of a new vehicle, this rate rises to 49%, a sign that leasing formulas are highly attractive and meet a real need. Engine type wise, buyers of new vehicles primarily owned petrol models, followed by diesel and hybrids, respectively.

Lastly, the average age of buyers – 65% of whom are men, compared with 64% in 2022 – remains stable at 58.7

After months of decline, the market exhibited a partial upturn in June, with higher registrations records for vehicles over 5 years old. Through uncertainty over the implementation of LEZs, the upturn continued in July, with registrations up 6% to 451,293 registrations in global. Newer models (under 5 years old) sales, which account for 30% of the market, fell by 2% to 135,274 registrations, mainly because they must fend off recent models supply challenges and persistently high prices. On the other hand, sales of 5–10-year-old vehicles rose by 11% to 100,125 registrations, and those over ten years old by 10% to 215,894 registrations.

aaadata@rumeurpublique.fr

Ingrid Seithumer – 06 64 10 91 78

Diane Loth – 06 22 73 56 43

AAA DATA, historical player, leverages extensive expertise in the field of enhanced data and detects, predicts, and identifies consumer behavior, needs and trends to anticipate tomorrow’s uses. It offers its customers tailor-made models. AAA DATA runs a reliable and proven database. Thanks to its data repository and expertise, AAA DATA has been able to develop cutting edge and innovative solutions and anticipate tomorrow’s needs, in a wide variety of consumer fields.

Les tendances et les comportements du marché automobile,

les analyses de nos experts Data.