Demande sur mesure

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous avez un besoin spécifique ? Vous souhaitez être accompagné et bénéficier d’une solution sur mesure ?

Nous contacter

L'équipe RH reste à votre écoute pour toute demande d'information complémentaire.

Nous contacter

Vous êtes intéressé(e) par une solution, vous recherchez plus d’informations ou souhaitez nous faire part de vos besoins.

Nous contacterAccueil > Actualités > Press release october 1st, 2023New passenger car market continues to grow in September

The French automotive market for new passenger cars (VPN) continued to grow in September, following a very thriving summer, particularly in August. While many industry professionals blame a certain sluggishness that holds vehicles order intake back, the market is catching up with 2021 level of activity.

According to data from AAA DATA, the enhanced data expert, new passenger car registrations in September amounted to 156,303 units, compared with 141,137 units in the same reference period of 2022.

Marie-Laure Nivot, Head of Automotive Market Analysis, at AAA DATA : ‘’The second half of the year inspired a great deal of skepticism, particularly due to the drops in orders recorded over the last few months. However, the third quarter keeps going in the right direction, thanks to an ongoing catch-up effect, with deliveries still buoyant”.

On the other hand, the used vehicle market showed a marked downturn. It fell by 2.8% in September with 409,846 transactions. .

In terms of energy mix, hybrid vehicles (35% market share, including 10% for plug-in hybrids) confirmed their ongoing breakthrough over the last few months, with a 32% increase in sales to 54,169 registrations (including 15,676 registrations for plug-in hybrids, up 35%)

1 - Renault

2 - Toyota

3 - Hyundai

Against the backdrop of the reshape of bonus conditions requirements, which has not yet had an impact on sales, 100% electric vehicles now account for 19% of the market with 30,172 registrations, a growth up 34%/

In terms of traditional powertrains, gasoline is struggling to protect its market share, with registrations up 1% to 52,946 units while diesel continues its rough slide: -35% with 13,268 registrations.

After several months of overall growth, driven by wiser prices and a lack of clarity surrounding the introduction of the LEZs, the used car market stalled in September, with 409,846 registrations, down 2.8%. Most recent models (30.4% market share) are still slacking, down 5.3% to 124,702 registrations. The 5- to 10-year-old segment (21.4% market share) continues to grow: +2.8% to 87,619 registrations, while the oldest models over 10 years old (48.2% market share) shows a marked decline, down 3.5% to 197,525 units.

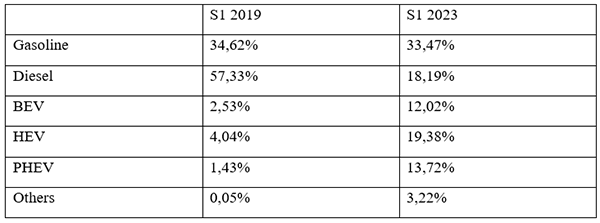

With a focus on fleet purchasing habits, 2019 serving as our benchmark (before the health crisis and the shortage of electronic components that have disrupted global production and logistic systems), the most striking key point is the fall of diesel penetration on the market. In the first half of 2019, 154,873 diesel vehicles were registered in the fleet market (public authorities, long-term leases, companies), followed by respectively 99,439 units in the first half of 2021, 70,627 units in the first half of 2022 and barely 48,187 units in the first half of 2023. The energy mix in the fleet market for private cars has changed drastically in the space of less than five years.

Le mix énergétique sur le marché des flottes (VPN) a été largement modifié en l’espace de moins de cinq ans.

The situation is different pertaining to new commercial vehicles purchased by fleets. Reigning in the first half of 2019 (92.45% of market share with 176,117 registrations), diesel has undoubtedly lost grounds although still largely prevailing (76.08% market share with 112,274 registrations). Electric LCVs are making progress but remain below the 10% share threshold: 8.73% market share for 12,884 registrations in the first half of 2023, compared with 1.7% share and 3,240 registrations in 2019 over the same period).

Two factors can explain that phenomenon. On the other hand, manufacturers’ offer is still limited, with little depth in the rang, and on the other hand, the purchase of a LCV is dictated by operational requirements, autonomy thus being a determining factor.

In the new passenger cars, it is obvious that private customers have eventually turned their back on diesel (5% of purchases in the first half of 2023). That trend is not as marked among professional fleets (18%) and short-term rental companies (13%). The “high-mileage driver” logic still prevails for fleets and most likely will stay this way until a new generation of batteries guaranteeing over 500km of range and optimized recharging times see the light of day.

For electric vehicles (BEV), private customers pave the way ahead (21% of purchases) for fleets (12%). The opposite is true for plug-in hybrids (PHEVs), a segment driven by fleets (14% of purchases) while private customers only account for 4% of purchases. The high prices of these vehicles have a lot to do with it. For fleets, PHEVs models enable a “smooth” transition for employees with company vehicles.

While concerns over residual values are sometimes raised to explain the cautious attitude of fleets, experts nevertheless consider the residual value of EVs to be high. There’s a reason for it: dealers, manufacturers and banks are gambling on the EV market. Obviously, adjustments are expected, but fears, particularly about rising electricity prices seem less well-founded, especially given the fact that price of a barrel of oil isn’t plunging either. ‘’It’s the tax system that needs to be observed, as the judge of peace. And it’s hard to imagine legislators duplicating the TIPP (domestic duty on petroleum product) on the KWh anytime soon if they really want the EV market to take off” says one observer.

While leasing offers are growing fast and are set to take over the financing market, a closer look regarding fleet selections reveals that the phenomenon is still in its infancy. Indeed, government agencies, for example, where vehicles volumes are admittedly small, tend to favor credit and cash purchases. Unsurprisingly, among short-term leasers, long-term rental offers are predominant. Long-term rental is also widely favored among business companies, specifically for PHEVs. However, on the other hand, BEV comes with a large mix of financing methods: credit and cash purchase, followed by long-term rental and leasing.

aaadata@rumeurpublique.fr

Ingrid Seithumer – 06 64 10 91 78

Diane Loth – 06 22 73 56 43

AAA DATA is a benchmark player and leverages extensive expertise in the field of enhanced data and detects, predicts, and identifies consumer behavior, needs and trends to anticipate tomorrow’s uses. It offers its customers tailor-made models. AAA DATA runs a reliable and proven database. Thanks to its data repository and expertise, AAA DATA has been able to develop cutting edge and innovative solutions and anticipate tomorrow’s needs, in a wide variety of consumer fields.

Les tendances et les comportements du marché automobile,

les analyses de nos experts Data.