Demande sur mesure

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous avez un besoin spécifique ? Vous souhaitez être accompagné et bénéficier d’une solution sur mesure ?

Nous contacter

L'équipe RH reste à votre écoute pour toute demande d'information complémentaire.

Nous contacter

Vous êtes intéressé(e) par une solution, vous recherchez plus d’informations ou souhaitez nous faire part de vos besoins.

Nous contacterAccueil > Actualités > Press release July 1st, 2023French Automotive Market on the mend in 2023 first half

The French automotive market continues to grow in June, ending 2023 first half on a positive note. However, there is a discrepancy between the dynamism of deliveries, catching up, and new orders drying up. In terms of energy transition, diesel is still losing significant ground while petrol is stabilizing. The situation benefits hybrid and electric vehicles that continues to be one bright spot, not to the extent of a tidal wave though.

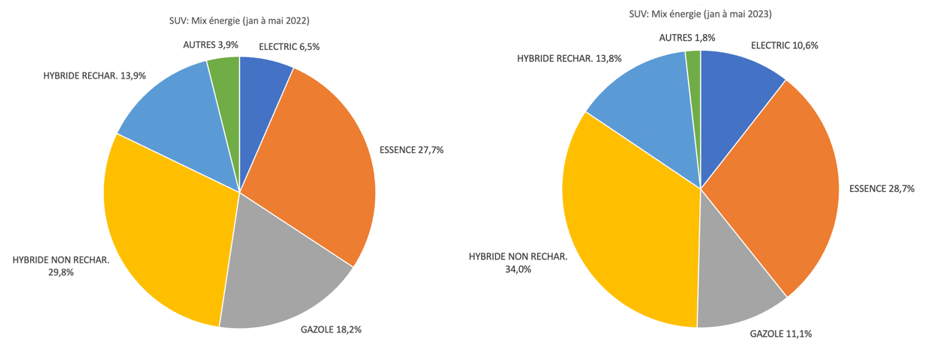

On the eve of a very uncertain upcoming second half, we have decided to look back on first half’s highlights, with a close-up on the top performer segment, the SUVs, which account for a large proportion of new product launches. Putting data and facts to the test, experts at AAA DATA wanted to know whether the EPZs implementation had a significant impact on French car purchases, both new and used.

In the automotive sector, June is traditionally strongly performing with the highest number of registrations, undoubtedly a do not miss month, often marked by open days and numerous sales events. June 2023 lived up to its billing, and above all, maintained the market’s upward trend. According to AAA DATA, the augmented data expert, the new passenger cars segment is up 12% compared to June 2022 with 190 847 registrations. The new LCV segment follows a similar pattern with a 16.9% growth to 42,700 units.

Pertaining to the used vehicle market, it ended a long series of months of decline and returned to the green, with 468,262 transactions, up 3.4%. The market was driven by the 10+ year-old used vehicle (+5.6%) and the 5–10-year-old one (+5.8%). The newer vehicles segment (less than 5 years old), remained negative in June (-1.3%)

In 2023 first half overall, not yet enough to offset pre-health crisis level, the NPCs market has regained some color: +15% for 889,776 registrations compared to 2022 same period. The best performance since 2021. The weight of shortages that hampered carmakers production facilities has eased, and some professionals speak of a mechanical catch up effect. It should be noted, however, that the pressure on vehicle transport is still very much in evidence and is severely disrupting certain manufacturers. In short, there is still a shortage of trucks and drivers.

The LCV market benefited from a smaller catch-up effect, displaying a slight increase of 3.8% to 190,722 units. The sector was hit hard by shortages and the related manufacturers arbitrages, which led to soaring delivery times.

Long accustomed to chasing records in the past recent years, the used-vehicle market confirms it’s now falling in line and even regrets a decline in the first half of 2023: -4.4% compared to last year, for 2,611,360 units. As an explanation, we can start by the obvious and recall that the supply of nearly new models remains highly limited, as a direct consequence of past tensions occurring on the new vehicle market. Moreover, surging prices on the used vehicle market are bound to put the brakes on purchases, more especially with the return of inflation. The situation therefore favors activity in the oldest models and diesel segments, which isn’t necessarily good news when it comes to environmental stakes. However, June has stopped the bleeding and suggests that the used car market is about to stabilize.

In the same market, for the first five months of the year, the breakdown of Crit’Air stickers was as follows: 32% of Crit’Air 0 and 1, 35% of Crit'Air 2 and 33% of Crit'Air 3 and above. It’s also worth noting that the corporate segment’s share of the new car market (6%) continues to grow, with an increase of 4%.

Marie-Laure Nivot, Head of Market Intelligence at AAA DATA: “Of the three scenarios forecasted for 2023 at the start of the year (1. optimistic, with a market getting its momentum back at its eminent 2 million new cars threshold; 2. pessimistic with a market of less than 1.5 million units sold and finally 3. ‘Business as usual’ confirming the market bouncing back but not enough to offset its pre-health crisis level), the latter seems to be confirmed by the results of this first half. However, the most pessimistic outlook has not yet to be totally ruled out”.

The new motorcycle market rose by 4.8% to 92,200 registrations in the first five months of 2023, mainly thanks to petrol bikes. Electric motorcycles are indeed still too rare and expensive. Additionally, depending on the market segment, the cultural change of shifting energy is significant for customers. Over the period, electric motorcycles are close to 5% market share, but on a flat trend.

After spectacular growth in recent months, the VSP market declined in the first five months of 2023: -4.7% for 9,073 units. The Renault Twizy is gradually vanishing from the scene (34 units) and some brands are not experiencing a very buoyant cycle. Aixam, the market leader, boasts a 44.7% share. The AMI effect, which single-handedly boosted the market, is returning to normal, even though Citroën still calls a 27.8% share. Given its positioning and price, the customer base can’t expand indefinitely. However, it has succeeded in rejuvenating the segment and changing the perception held by many observers. Likely, the VSP market is unlikely to witness any significant new growth in the short term. Indeed, the introduction of electric VSP’s on the market will not be enough, because as with new cars, it will lead to higher product prices, which will de facto drive away a certain number of potential buyers.

First and foremost, we need to make the necessary distinction between Chinese brands that establish themselves in Europe, including France, and brands that produce in China and then export to Europe. The most emblematic example is Dacia’s Spring, although premium models can also be found in this category (BMW or Volvo, for instance). By 2030, China is expected to account for over a million vehicles imported to Europe. There’s no need to cry wolf yet if we consider that these import from China will come, in almost equal proportion, from Chinese manufacturers and European brands.

Currently, market figures hardly reveal anything but hype about a supposed Chinese invasion of France, as well as Europe. In fact, Chinese-made vehicles sold in France accounted for 0.8% of the market in the first five months of 2023. MG’s successful launch has been widely commented, and rightly so, but it remains locally limited in volumes (9,033 units over the period). On the other hand, new brands are set to exacerbate the trend, led by BYD, “the next big thing” according to many experts. Runner-up is Lynk & Co, whose subscription offer serves as a laboratory for Volvo and Polestar (not yet distributed in France) within the Geely Group, and to a lesser extent, Smart or Leap motor.

Structurally, electrification is opening favorable gaps for Chinese brands to fill, having mastered this technology. No massive effect yet, even if the idea that these manufacturers are finding their place is entirely well-founded. A look in the rear-view mirror at the history of Japanese and Korean brands is enough to confirm this. Moreover, MG, BYD and Geely are most likely to inspire other Chinese Brands, most particularly premium brands, Tesla has led the way proving “yes we can”. Now, there are 29 Chinese-produced brands distributed in Europe (including 6 non-Chinese brands), but most of them are confidential or even marginal.

In the private customer market, conventional credit has bounced back (+21.2% over the first five months of 2023), and now accounts for 50% of financing in this segment. At the same time, leasing with an option to purchase continues to expand, so does long term car rental (LLD).

In the corporate segment however, credit continues to decline. LLD is benefiting from this, with double-digit growth, while financial leasing remains buoyant (+36% over the period). Short-term rental (S.T.L) has regained momentum, thanks to a much better distribution of vehicles by automakers to their respective channel, and the classic pre-summer seasonal boost.

Overall, more than half of new vehicles are now financed via leasing. The trend is set to intensify with the development of electric vehicles (EVs). Indeed, it helps to smooth out the high price of EVs in France (40,711 euros on average, according to the latest AAA DATA report).

While diesel is fading away from the landscape, which can now also be explained by the wide variety of range available, petrol has bounced back over the first five months of the year (+19%), while hybrids (HEVs and MHEVs) continue to progress. Plug-in hybrids are more resilient than some experts predicted. Last, but not least, BEHs show the strongest performance, driven by a growing a growing range of products and praised by carmakers, particularly in view of CAFE standards. In terms of market share, the expansion remains very gradual (14.9% share) and by no means look like a tidal wave.

Although they remain largely unknown to the French, as several studies have shown, EPZs are still a source of concern, and even tension. Some are quick to speak of a “social bomb” and predict a massive comeback of the Gilet Jaunes movement whenever the subject of EPZs comes up. This didn’t escape the scrutiny of French President Emmanuel Macron. In March 2023, the Senate launched a fact-finding mission on the subject, whose report, nearly a hundred pages long, was presented on Wednesday June 14, 2023, by Philippe Tabarot, a republican senator from the region Alpes-Maritimes.

Among the recommendations put forward by the senators is the easing of deployment timetable deemed too rapid, i.e., moving from 2025 to 2030.

Christophe Béchu, France’s Minister for Ecological Transition and Territorial Cohesion, was therefore keen to make a few clarifications, while reminding that other reports from the consultation process were expected in July, notably in Toulouse and Strasbourg Euro metropole.

“The French government is not planning to ban Crit’Air 3 vehicles in 2023 in the 43 conurbations covered by the EPZs. This will only apply to cities that exceed European air quality thresholds, i.e., currently five cities, Paris, Lyon, Marseille, Rouen, and Strasbourg and solely to cars (commercial vehicles or heavy goods vehicles are excluded). The Government is not imposing anything on Crit’Air 2, and the label does not even appear in the French Climate and Resilience Act. The figure of 13 million drivers affected by the obligations imposed by the State is therefore completely farfetched” asserted the Minister, stressing that “the State’s timetable was the right one, but that we must of course adapt the implementation of the EPZs to the reality of the territories”.

In concrete terms, the experts at AAA DATA wanted to know whether the roll-out of the EPZ had an impact on new and used vehicles purchases by the French people falling under these zones’ restrictions.

In the Greater Paris area, the effect of the EPZ is not very significant. In the concerned departments as well as in the municipalities directly involved, electric vehicles purchases rose from 2% to 5% between 2020 and the first five months of 2023 (4% in 2022). Over the period, new and used vehicles purchases of Crit’Air 1 rose from 40 to 51%, with no difference whether municipalities are affected by EPZs standards or not. The increase in the number of Crit’Air 1 is mainly at the expense of Crit’Air 2 (down from 32% to 24%). Looking at the first five months of 2023, Crit’Air 0 and 1 account for 56% of purchases and Crit’Air 2 for 29% of volume. Few vehicles would hence be subjects to a ban from circulating in the EPZ or likely to be ticketed.

These observations are true for most of EPZs in force, namely Nice, Aix-Marseille (where the proportion of Crit’Air 0 and 1 even falls below 50% of purchases), Reims, Strasbourg, Lyon, Toulouse, Montpellier, and Grenoble (where electric vehicles account for just 3% of new and used vehicles purchases in EPZ municipalities). In each case, there has been a slight shift towards Crit’Air 1 vehicles since 2020 but no the extent of upsetting the existing balance upside down.

Two exceptions are worthy of note. In Saint-Etienne, purchases in municipalities affected by EPZs are highly concentrated on electric vehicles (7%) and Crit’Air 1 models (73%). In the department, Crit’Air 1 only account for 34% of purchases, so we can speak of a real EPZ impact on car consumption. The same applies to Rouen, where Crit’Air 1 account for 73% of purchases in EPZs related municipalities, compared with 45% within the whole department. Here again, decisions are made at the expense of Crit’Air 2 or even Crit’Air 3.

aaadata@rumeurpublique.fr

Ingrid Seithumer – 06 64 10 91 78

Diane Loth – 06 22 73 56 43

AAA DATA leverages historical and extensive driven valued data expertise. We detect the right insights on consumers trend and the market to predict uses of tomorrow and deliver our customers tailor-made solutions. AAA DATA uses and builds a reliable and proven database. Thanks to our strong data repository and expertise, AAA DATA shapes and provides powerful cutting-edge solutions to anticipate tomorrow’s needs in a wide range of consumer sectors.