Demande sur mesure

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous souhaitez être accompagné

et bénéficier d’une solution

sur-mesure ?

Vous avez un besoin spécifique ? Vous souhaitez être accompagné et bénéficier d’une solution sur mesure ?

Nous contacter

L'équipe RH reste à votre écoute pour toute demande d'information complémentaire.

Nous contacter

Vous êtes intéressé(e) par une solution, vous recherchez plus d’informations ou souhaitez nous faire part de vos besoins.

Nous contacterAccueil > Actualités > Press release April 1st, 2023 :Bright Spell ahead in the French Automotive market

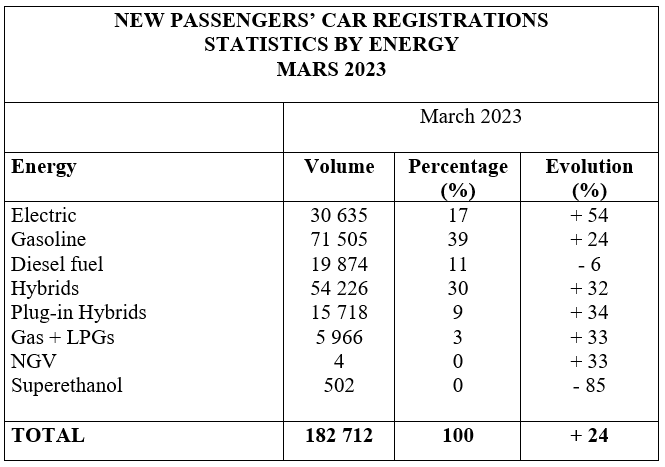

The upturn in the new passenger market continues as the market is rising for eight months in a row. In March 2023, registrations rose by 24%. The used car market continues to struggle, with a decline of 4.7%.

AAA DATA, the augmented data expert, records 182 712 new car registrations in March 2023, versus 147 078 in March 2021 and 182 774 in 2021. March is traditionally a strong month for sales, with open days and boot sales taking place in many sales outlets. It should also be noted that the standards of comparison remain low: in March 2022, sales had fallen by 20%.

Electric engines continue to experience their breakthrough moment. While their registrations have increased by 54%, they now account for 17% of the PCV market, four points more than in March 2022. Diesel engines keep falling free with a 6% drop in registrations and merely account for 11% of the market share. On the other hand, gasoline engines are up 24% to represent 39% of the market. Hybrids keep improving their performance (+32% increase in registrations, including +34% for plug-in hybrids) and catches up with gas car in terms of market share (30%). The alternative fuels (Gas + LPG) also performed well with a 33% boost in registrations.

Riding the wave of electric cars momentum, Chinese brands are gradually moving ahead. Tesla still ensures the top spot on the podium (8,710 registrations in March 2023, up 80%), followed by runner-up Peugeot (4,033 registrations, up 76%), Renault (3,681 registrations, up 39%) and Dacia (3,481 registrations, up 65%). Chinese MG (1475 registrations, up 161%) hounds Fiat (2022 registrations, up 29%) currently in fifth position.

Even if volumes are not yet significant for all of them, there are now seven Chinese players including a new one, on the French electrified market (electric and hybrid). This is unprecedented. As far as electric engines are concerned, alongside MG, there is Volvo, now owned by the Chinese group Geely (367 units), as well as Leap Motor (19 units), Aiways (10 units) and BYD, which entered the market this month (1). Ultimately, in the hybrid segment, Lynk CO (294 units) is beyond doubt also making progress.

It’s obvious that the French automotive market arouses covetousness, especially the electric ones, for Chinese manufacturers. And for good reason. China is now a key player in battery production. Having already marketed no less than six million electrified vehicles on its own territory, China is also one step ahead in this area. But that’s not all. In France, Chinese brands have managed to stabilize their average selling price, and even lower it (-12% for Volvo). At the same time, the average price of new electric cars has risen by 7% in 2022, to 40,711 euros (average list price of registered cars, excluding options and discounts)

In general, Chinese brands compete with the leaders with lower prices, on the main market segments (A, B-SUV, C, C-SUV and D-SUV). For example, MG (33 116€) and Seres (27 520€) engaged in a frontal attack with Renault’s price positioning (34 057€), Peugeot (37,289€), Citroën (38 869€) and Fiat (30 937€). For its part, Volvo has revamped its brand positioning into a more premium space (average price of 53 133€) and can overshadow the leader Tesla (56 741€) as well as traditional brands on their way to electrification and that do not have a very high-end image like Ford (67 765€).

Julien Billon, Managing Director of AAA: « The technological choice of electrification upsets the established order among the manufacturers on a national level as much as worldwide. With Chinese brand’s entering French market, the market shares of historical players are likely to be hard sought after and fought for».

The used car market continues to decline, still heavily affected by manufacturers difficulties to fill orders for new vehicles and constraints associated with low emissions zones. In March, it plummeted by 4.7% with 482,428 registrations. Most recent models (less than 5 years old), which account for 31% of the market) are the most impacted (-11%). Models between 5 to 10 years old (21% of the market) fell by -1.5%- and 10-years older models (47% of the market) decreased by -1.3%.

aaadata@rumeurpublique.fr

Ingrid Seithumer – 06 64 10 91 78

Diane Loth – 06 22 73 56 43

AAA DATA leverages historical and extensive driven valued data expertise. We detect the right insights on consumers trend and the market to predict uses of tomorrow and deliver our customers tailor-made solutions. AAA DATA uses and builds a reliable and proven database. Thanks to our strong data repository and expertise, AAA DATA shapes and provides powerful cutting-edge solutions to anticipate tomorrow’s needs in a wide range of consumer sectors.

Les tendances et les comportements du marché automobile,

les analyses de nos experts Data.